Taxing Unhealthy Food And Drinks To Improve Health

Taxing Unhealthy Food And Drinks To Improve Health

Understanding Unhealthy Food And Drinks

Unhealthy food and drinks are those containing saturated fat, trans fat, cholesterol, added sugars, refined grains, and sodium. These food and drinks are usually high in calories, but lack the essential nutrients such as vitamins, minerals, proteins, and fiber. Examples of unhealthy food and drinks include fast food, processed snacks, sugary drinks, and energy drinks. Unhealthy foods and drinks are linked to a number of health problems such as obesity, type 2 diabetes, and heart disease.

The Need For Taxing Unhealthy Food And Drinks

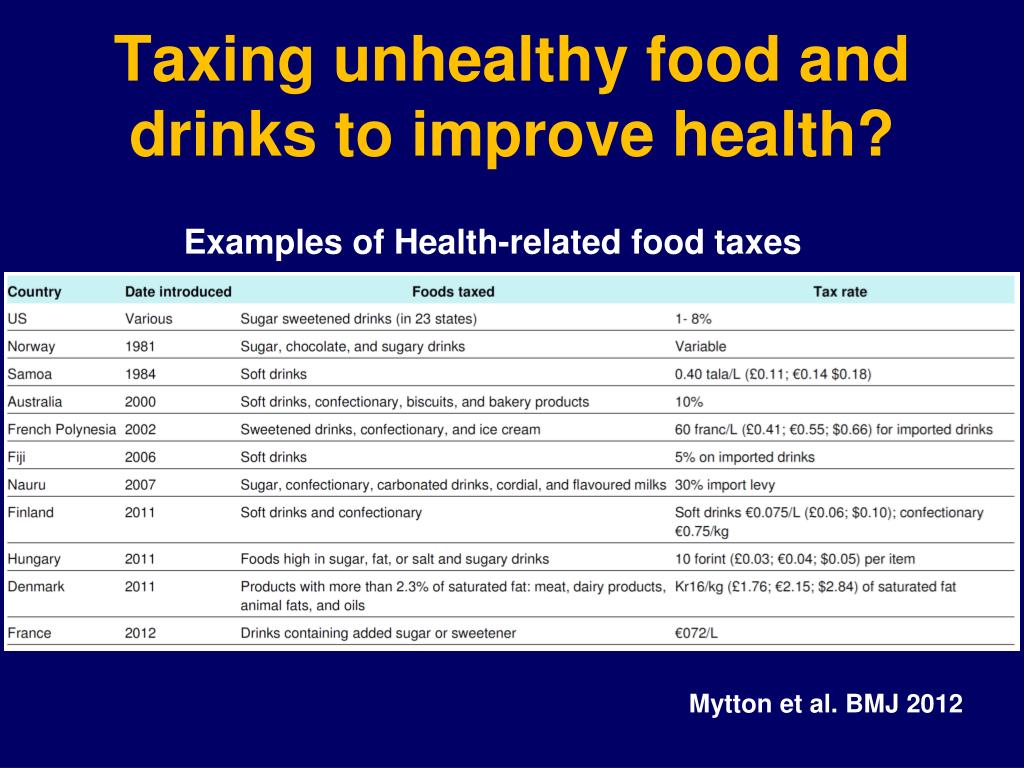

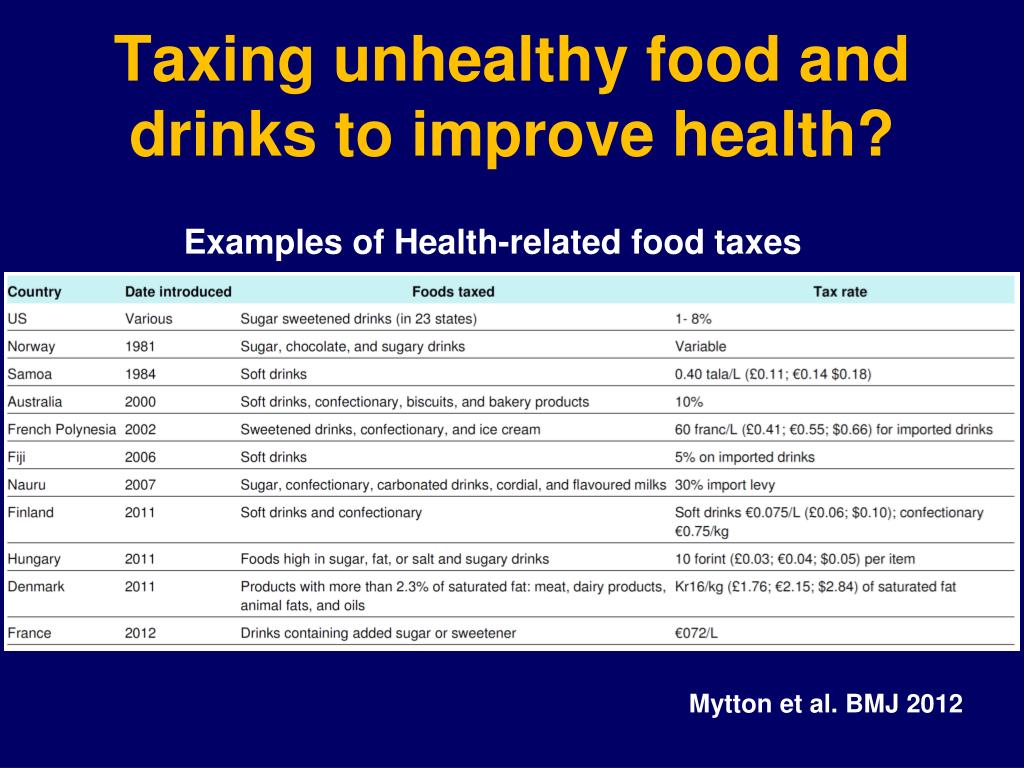

In order to reduce the intake of unhealthy food and drinks, experts suggest that governments should impose taxes on them. This is known as a ‘sin tax’ and it has already been implemented in many countries such as the US, UK, Denmark, Mexico, and France. These taxes are imposed on unhealthy food and drinks to discourage people from purchasing them, and also to generate revenue for governments.

Benefits Of Taxing Unhealthy Food And Drinks

Taxing unhealthy food and drinks has a number of benefits, the most important being that it can help reduce the consumption of such food and drinks. This, in turn, can lead to improved public health, as people will be consuming fewer unhealthy items and more nutritious food. Furthermore, it can also help to reduce the number of people suffering from obesity and other health problems related to unhealthy eating habits. Moreover, it can also generate extra revenue for governments which can then be used to fund public health initiatives.

Challenges Of Taxing Unhealthy Food And Drinks

While taxing unhealthy food and drinks can have numerous benefits, there are also some challenges associated with it. For example, it can be difficult to determine which food and drinks to include in the tax and how much to charge. It can also be difficult to implement the tax in a way that is fair to all people and businesses. Moreover, some people may be unfairly penalized if they don’t have access to healthier alternatives.

Conclusion

Taxing unhealthy food and drinks is a useful way to reduce the consumption of such items and improve public health. However, it is important to ensure that the tax is implemented fairly and that people have access to healthier alternatives. Ultimately, it is up to governments to decide if and how to tax unhealthy food and drinks, and to make sure that any revenue generated is used to fund public health initiatives.

PPT - DIABETES THE NEW EPIDEMIC PowerPoint Presentation, free download

(PDF) Taxing unhealthy food and drinks to improve health

Taxing unhealthy food or drink would encourage half of Brits to cut

Taxing unhealthy food or drink would encourage half of Brits to cut

Just Realized Why the NDP is Taxing Carbonated Drinks (Even Diet) but

Will taxing unhealthy food help fight childhood obesity? - Stoke-on

Would Taxing Unhealthy Foods Improve Public Health? | NutritionFacts.org

unhealthy food you may think is healthy - PositiveMed

Taxing sugary drinks would boost productivity, not just health

Unhealthy Diets Can Be Curbed By Government Action, Says UN Expert: Why